In addition to the currently disclosed orders, the Eurofighter consortium envisions up to 74 aircraft from domestic orders and 130 from export customers.

Eurofighter discussed future growth scenarios for its orders portfolio both from partner nations and export customers as part of a press release about the scale of the Eurofighter Typhoon programme’s contribution to economies across Europe. These new orders, which could add to the ones already acknowledged by Germany and Spain, would support the production lines and preserve the know-how until the FCAS aircraft are ready for mass production.

The report is part of the Eurofighter Economic Impact Assessment study published on April 9, 2024, by Strategy&, part of the PricewaterhouseCoopers (PwC) network. The in-depth report examines the entire spectrum of development, production, and support activities, encompassing the four Eurofighter Typhoon partner nations of the United Kingdom, Germany, Italy and Spain.

Giancarlo Mezzanatto, Chief Executive Officer at Eurofighter Typhoon, said: “The vital role that the Typhoon performs to keep Europe’s skies safe is widely known to all, however people are often less aware about the incredible economic benefits that the programme also brings.

Interesting slide from @eurofighter press release on the programme’s economic impact shows upwards of 74 additional partner nation sales. Unlikely any from UK, so potential Halcon III for Spain and T5 for Germany, and watch out for those additional Italy orders I touted… pic.twitter.com/NpvzlfyZbN

— Gareth Jennings (@GarethJennings3) April 9, 2024

Focusing on the next decade, the report shows the current economic benefits of the Eurofighter programme as well as anticipating future economic contributions. Two scenarios are analyzed: a “base” scenario, which includes the recent new orders of partner nations, and a “growth” scenario with opportunities also for export. The report continues saying the base scenario would sustain a minimum production rate for a few years, but further domestic and export orders are needed.

The “base scenario” takes into account orders for new Eurofighter Typhoons from Spain (Halcon I and II) and Germany (Quadriga). This scenario shows that, for the next decade, the programme is set to contribute €58 billion to the GDP of the four core nations’ economies; generate tax revenues of €14 billion for the respective governments; and support 62,700 jobs annually.

“The Eurofighter Typhoon programme directly boosts European economies and supports tens of thousands of crucial aerospace jobs – benefiting the communities where we live and work,” said Mezzanatto. “There is also significant spill over in regions where Eurofighter production lines are located and where the programme often sustains SMEs, start-ups and educational institutions.

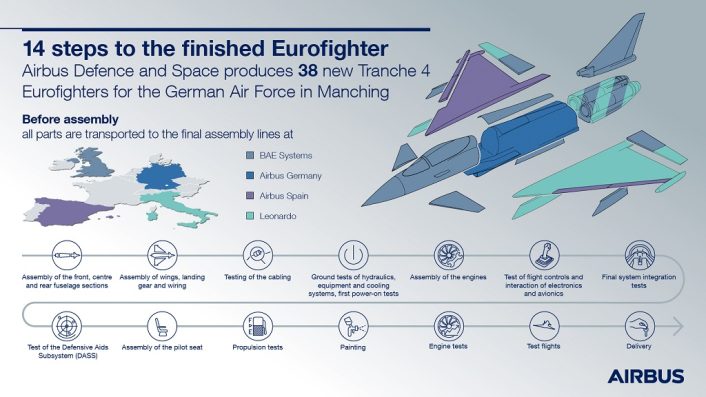

This scenario includes a total of 83 aircraft, of which 38 are part of the German Air Force’s Quadriga order, 20 are part of the Spanish Air Force’s Halcón order and 25 are part of the subsequent Halcón II order. According to current planning, Airbus previously said production of Eurofighter in Germany will come to an end in 2030 with the delivery of the last Tranche 4 aircraft.

Those numbers increase significantly in the report’s “growth scenario” with opportunities for sales of approximately 200 Eurofighter Typhoons on the domestic and export market. This scenario shows, for the next decade, a programme contribution of €90 billion to GDP; tax revenues of €22 billion generated; and more than 98,000 jobs each year. The benefit of future export opportunities would mean that around 30 per cent of the core nation investment would return as tax revenues.

The report further outlines that up to 74 new aircraft orders could come from domestic opportunities and 130 could come from new export orders. According to Airbus, these orders would also avoid a production gap of 10 years without orders for the domestic industry until the Future Combat Air System (FCAS) goes into operation in 2040.

Airbus previously mentioned that up to 100 new Tranche 5 aircraft would be required to avoid the gap, while the Strategy& report envision double of the aircraft as part of the new possible orders. The customers, however, are not known at this time as no orders have been inked yet.

A rumor started last year mentioned that Italy would acquire 24 new aircraft, however this has not been confirmed by the Italian Air Force nor Leonardo. German industry is also pressuring the German government to order 50 Tranche 5 Eurofighters by next year to support the production lines. Both make up the 74 aircraft envisioned in the domestic opportunities of the “growth” scenario.

As for the export opportunities, after Germany removed the veto, Saudi Arabia could get 48 new Typhoons to increase its 70-aircraft strong fleet. Eurofighter is also in talks with Poland, which is looking to acquire one or two full squadrons, which equates to 16 or 32 aircraft. Turkey also expressed interest in acquiring 40 Typhoons. There have been rumors also about a possible sale to Egypt, but it never materialized so far.